2024 Tax Married Jointly Rate

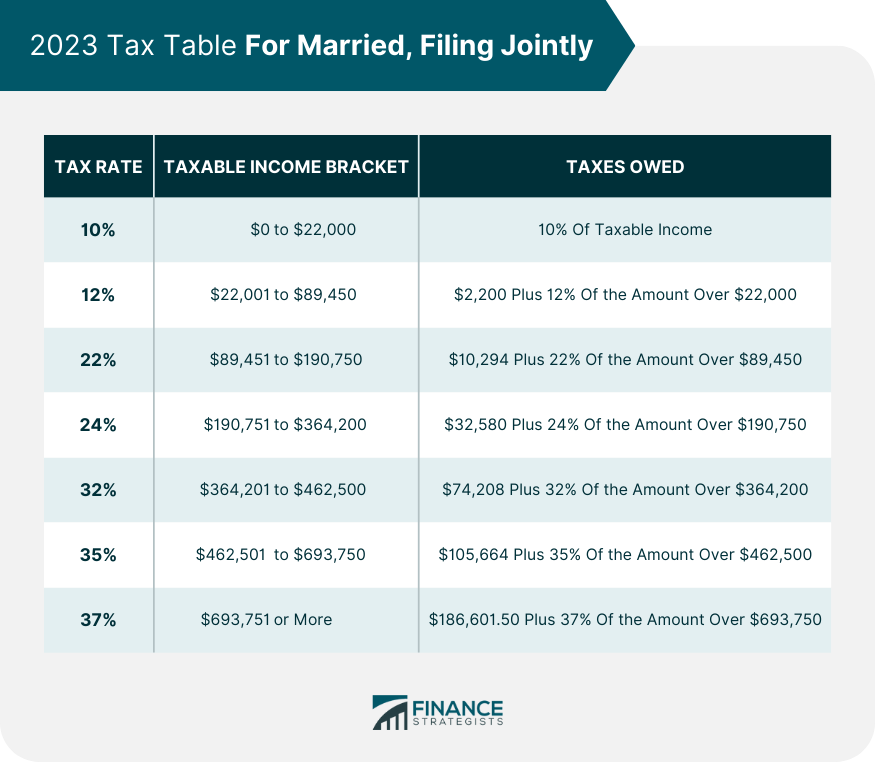

2024 Tax Married Jointly Rate. For example, in 2019, a married couple filing jointly with a household income of $600,000 would have been taxed at a top tax rate of 37%. Your bracket depends on your taxable income and filing status.

The standard deduction for couples filing jointly is $29,200 in 2024, up from $27,700 in the 2023 tax year. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2024 Tax Married Jointly Rate Images References :

Source: alissayelizabet.pages.dev

Source: alissayelizabet.pages.dev

Irs Tax Rates 2024 Married Jointly Anissa Karissa, Filing options include single, married filing jointly, married filing separately, head of household and qualifying widows and widowers.

Source: www.trustetc.com

Source: www.trustetc.com

2024 Tax Brackets Announced What’s Different?, The top tax rate will remain at 37% for married.

Source: terriyfaustine.pages.dev

Source: terriyfaustine.pages.dev

2024 Tax Rates Married Filing Jointly Nonah Annabela, Filing options include single, married filing jointly, married filing separately, head of household and qualifying widows and widowers.

Source: aliceyblakelee.pages.dev

Source: aliceyblakelee.pages.dev

2024 Married Filing Jointly Tax Table Phebe, The tax rate for individuals (single filing) earning under $400k will be preserved.

Source: elfiebchristabel.pages.dev

Source: elfiebchristabel.pages.dev

Marriage Tax Brackets 2024 Janaya Marylou, The tax rate for individuals (single filing) earning under $400k will be preserved.

Source: ivonneyelisabeth.pages.dev

Source: ivonneyelisabeth.pages.dev

2024 Tax Rates Married Filing Jointly In India Leia Raynell, The top marginal income tax rate of 37 percent will hit.

Source: www.financestrategists.com

Source: www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2024 Rates, For the tax year 2024, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2023.

Source: dacieynettle.pages.dev

Source: dacieynettle.pages.dev

Social Security Tax Rate 2024 Married Filing Jointly Juana Marabel, See current federal tax brackets and rates based on your income and filing status.

Source: olwenvkoressa.pages.dev

Source: olwenvkoressa.pages.dev

Irs Tax Rates 2024 Married Filing Jointly Liane Natala, Suppose you’re married filing jointly and you have $260,000 magi, which includes $150,000 in interest, dividends, and capital gains.

Source: korryylenora.pages.dev

Source: korryylenora.pages.dev

Fed Tax Rates 2024 Married Lynde Electra, Filing options include single, married filing jointly, married filing separately, head of household and qualifying widows and widowers.

Posted in 2024